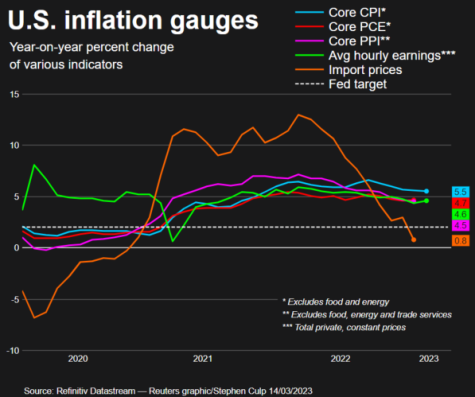

Inflation is Slowly Going Down but Not Enough

April 12, 2023

Previously I wrote a story on inflation and how it was going up tremendously by the cost and the rates have been higher than ever. As of the month of March things slowly started to go down but not enough to where people’s pockets aren’t hurting by paying ridiculous prices.

A lot of the inflation we see going on is because it’s tied to the Federal Reserve’s decisions about how high interest rates should be and it’s predicted that at the rates will be discussed to rise by 0.25%. The main hope of the Federal Reserve doing this and I increasing inflation is so they can borrow and hire more costly for business. To a lot of people this isn’t a fair trade off because the workers who feel secure about their jobs are comfortable spending and this creates demand in the economy which ultimately creates demand in the economy and drive price surges.

Inflation gives a lot of people benefits but it’s kind of an unjust, just thing and overall inflation it just hurts them. With the growing prices over the past year it has been crazy and kind of a shock to people and hurt them because some people can’t afford the new prices that are happening and with there being a decline it releases some stress to people but not much. Although prices are starting to go down it still doesn’t do much for people when there wage growth is going down as well because it doesn’t help people who are working extra hours but are getting paid 6% less than what they were getting paid before. Overall, I think inflation does more harm than benefit people because there are a lot of things people may need that they can’t because of the increase in inflation and the decrease in wage growth.